How can I transfer my money from Canada?

Unfortunately the Canada tax authority does not deposit tax refunds into foreign bank accounts.

After you left Canada, and when you file your last Canadian tax return the best option to receive the refund is to keep your Canadian bank account open until the tax return is processed and deposited.

- If you filed a Canadian tax return in previous years, you received the money via direct deposit and still have the same account open, the tax refund will automatically be deposited to your Canadian bank account.

- If the account is already closed, a cheque will be issued to the address provided in the tax return.

I received a tax refund via cheque, how do I cash it?

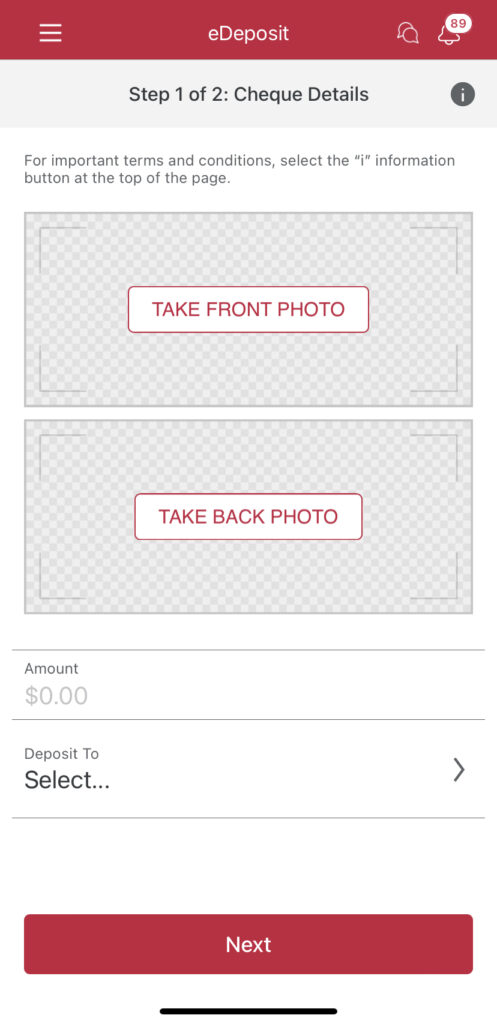

In today’s modern times quite all Canadian bank accounts have an app where you can deposit the cheque via online banking in 2 simple steps. In the photo to the right you can see how it looks like on the CIBC banking app. You take a photo of the front and back, enter the amount and in the next step you submit the photos.

Government cheques usually do not have a waiting time until they are cleared. But you should wait until the tax refund amount shows up in your balance in the bank account.

Then it’s time to close the bank account. Before you can do that, you must bring the balance to zero which means you need to transfer all money out first.

How do I transfer my money out from Canada to my home country?

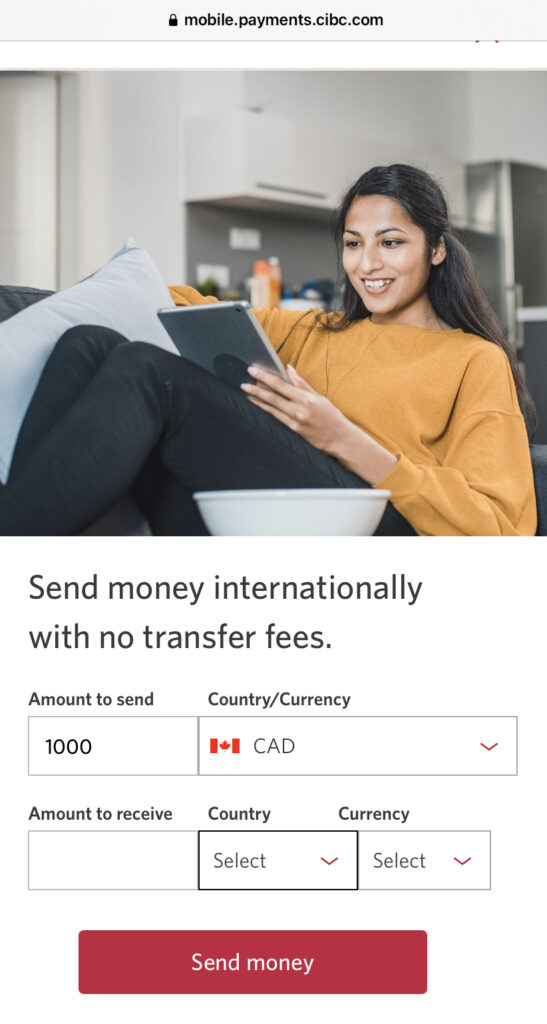

Many work and travellers on an IEC work permit use the newcomer account from CIBC. This means in the account they have the option to make an international “Global Money Transfer” to their bank in their home country. This is available in 49 countries worldwide. At CIBC this transfer is free. The good thing, you can also send the money directly to a Visa credit or debit card, all you need is a Visa card number.

If you are with another bank, please check their international money transfer fees.

What other options are there?

- Wise -

Another most recommended option to transfer your money out from Canada is a third party provider named Wise. It was previously called Transferwise, I am sure you heard of them before. Wise launched in 2011 in the UK and has over 13 million customers around the world.

With Wise you have one of the best exchange rates in the international money transfer world. When you transfer money you will always get the mid-market exchange rate.

The transfer fees depend on the amount you send, the type of currency the recipient will get and the payment method.

What other options are there?

- PayPal -

If you don’t want to sign up for other third party providers, PayPal is the go-to solution for many work and travellers. The exchange rate is a bit higher than other providers and PayPal charges higher transaction fees, but it is definitely a solution for an international money transfer.