GST/HST Credits

I've already left Canada and I'm still receiving money from the tax authority!

You have filed your tax return in Canada as a resident for tax purposes? After you left Canada, did you receive extra payments (in addition to your tax refund) every quarter? If you still receive money from the tax authority after leaving, one step has been forgotten:

After returning home, you had to call the tax authorities and tell them the departure date and the new address so that they don’t automatically send you extra cheques that you have to pay back later anyway.

A brief overview of the GST/HST credits:

- The GST credit is a tax-free payment for low-income earners.

- It is granted automatically when you submit the tax return as a “resident for income tax purposes”.

- You don’t have to apply for it separately.

- The calculation of the GST credit is based on the total world income for the previous year.

- The first payment always starts in July.

- You are only eligible for the GST credit as long as you are a resident in Canada in the month before the CRA makes a payment and at the beginning of the month the CRA makes a payment.

- The GST credit is paid quarterly. (July, October, January, April)

If you filed your tax return for the 2022 tax year, the worldwide income from 2022 was used for the calculation of the amount of GST/HST credit. The four payments then were:

- July 2023

- October 2023

- January 2024

- April 2024

Why do I have to pay back the GST credits?

As mentioned above, the GST credit is only available as long as you are in Canada.

Since you left Canada during the tax year, you are no longer eligible for the GST credit after departure. When you file the tax return for the year you left Canada, you must report the departure date. Then the tax authority will automatically determine what amount you have to pay back and send you a repayment request letter. Wait for this letter first.

Here is the clarification for the tax year:

- Left Canada between January – June ==> no GST credit

- Left Canada between July – September ==> you are only eligible for the payment July

- Left Canada between October – December ==> you are only eligible for the payments July + October

I received cheques, but I haven't cashed them yet, what do I do?

My recommendation is to cash the cheques anyway, because the amount could include months that you are eligible for.

If you then submit a tax return for the year of your departure from Canada, the tax authority will automatically calculate the amount of the GST/HST. Depending on when you left, you have to pay back all or only a part of it.

You will then receive a letter with the exact statement of these GST/HST credits and the request to pay the amounts back. Very often, the tax authority offsets the outstanding amounts against the tax refund. This means your tax refund will be lower.

I never got the checks because I didn't change the address in the CRA Account

In the system of the CRA, these cheques are considered to have been “paid out“,

- It doesn’t matter whether you cash them or not

- It doesn’t matter if they went to a wrong or old address.

These will not disappear from the system. You have to actively take care of it. You have to call the CRA and ask them to cancel the checks.

Call from outside Canada: 001-613-940-8495

Monday through Friday from 9 a.m. to 5 p.m. Eastern Time.

Try a calling app so you can make calls from Wi-Fi. For example Skype.

When you call, you have to identify yourself. Have the following ready:

- SIN

- Address you provided on your last tax return

- PDF of your tax return (they will ask for the amount “in line 10100 or 15000 of your tax return”)

I have to repay the GST credits, what options do I have?

If you no longer have a Canadian account, there is a third party recommended by the CRA where you can pay by credit card. However, fees apply. If you’re no longer in Canada, this option is the only one.

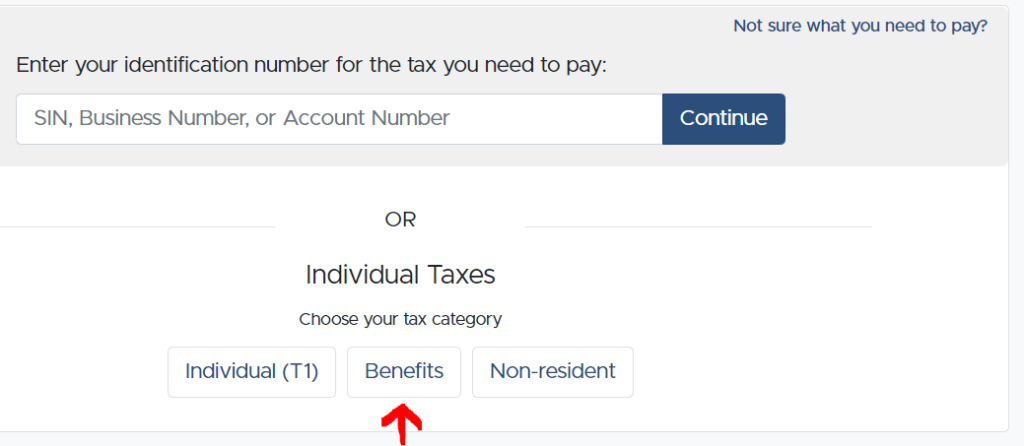

PaySimply is recommended by the CRA and these are the steps to click:

- Individual Taxes

- Benefits

- Enter your SIN and complete the payment.