Canada Taxback - Calculation Request

A few important info pieces before you can start

This ensures that there are no misunderstandings later and that everything runs smoothly.

The Taxback service is only offered to Work and Travellers, who were in Canada under the IEC program

(Working Holiday, Young Professionals, Co-Op Internship).

Tax filing for the tax year 2025 opens at the end of February. Come back then and we’ll get started right away.

- By submitting the form, you confirm that you have understood the Taxback process outlined >> here <<

- A service fee of $10 applies for the calculation, which is payable immediately after submitting the form.

- The questions in the form relate to the tax year. The Canadian tax year runs from January 1st to December 31st.

- NO tax returns for the province of Quebec. Sorry.

- NO tax returns for self-employment. Sorry.

- If you wish to submit multiple years, complete a separate form for each tax year. Only pay the $10 service fee once.

- Do not include any sensitive information in the form fields (e.g., date of birth, address, SIN number). Not required at this stage.

- The request form is hosted on a secured, SSL-encrypted website.

If you are missing a T4: first wait to receive all T4s from all employers.

The Record of Employment (ROE) is not sufficient, as it only shows your earnings and no tax deductions.

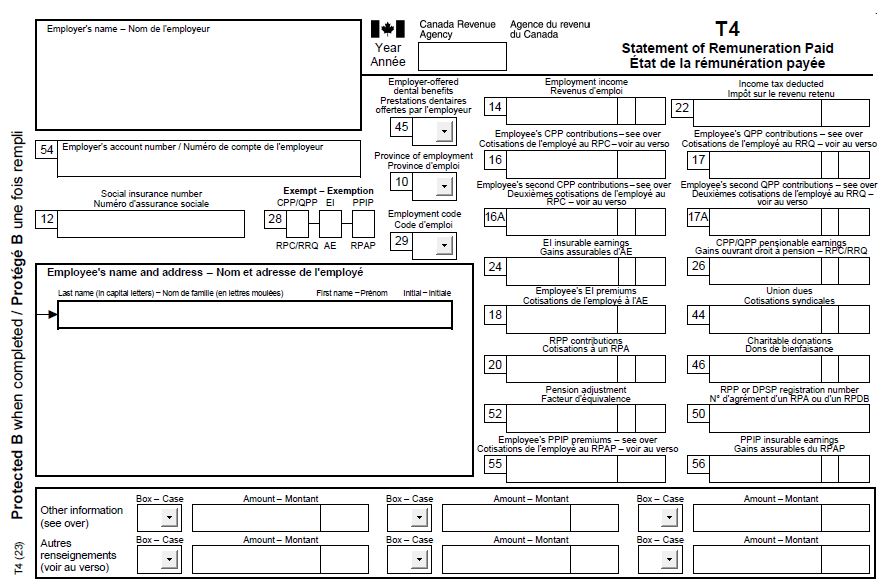

Make sure you wait until you’ve received all T4s from every employer before filing. The Canada Revenue Agency (CRA) also has copies of your T4s, so you can’t leave any out by saying you didn’t receive them. Below is an example of what a T4 looks like.

By law, employers must issue T4s by the last day of February. If you haven’t received yours by mid-March, contact your employer and ask for a copy. Let them know there’s a late-filing penalty starting at $10 per day for employers who miss the deadline. > Here is the link you can send them for more pressure. <

If you’ve filed Canadian taxes before and have an online CRA Account, you can download your T4 slips straight from there.