How do I cash a CRA cheque?

Cash your cheque at a Canadian bank

Here’s a little-known fact: Government of Canada cheques never expire! That’s right—whether it’s been sitting in your drawer for months or even years, you can cash it in Canada at any time.

But that’s not all. Did you know you can cash these cheques for free at any Canadian bank, even if you’re not a customer? Whether it’s a tax refund, benefit payment, or another type of government-issued cheque, you have the legal right to access your funds without paying a cent.

According to the Financial Consumer Agency of Canada (FCAC), you can cash a Government of Canada cheque at any Canadian bank, as long as you meet these conditions:

- Cheque Amount: The cheque is $1,750 or less.

- Identification: You provide acceptable ID, such as a passport or Canadian driver’s licence.

More information here about >> Cashing a Government of Canada cheque

What If the Cheque Is Over $1,750?

If the cheque is for more than $1,750 and you’re not a customer of that bank, the bank may refuse to cash it. In such cases, you will need to deposit the cheque into your own bank account. Banks are not obligated to cash cheques over this amount for non-customers.

Cash your cheque online with e-Deposit

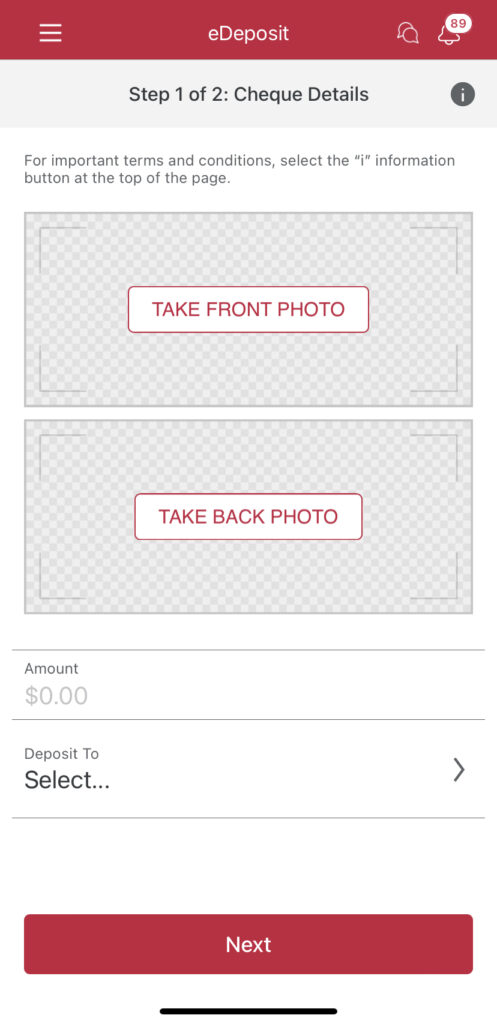

Many banks offer an online banking feature called e-Deposit, allowing you to deposit your cheque remotely using your smartphone. To use e-Deposit:

- Open your bank’s mobile banking app.

- Select the option to deposit a cheque.

- Follow the prompts to take clear photos of the front and back of your cheque.

- Confirm the deposit details and submit.

Funds are typically available within one to two business days, depending on your bank. This method is perfect if you want to avoid going to a branch.

More info >> here.

Cash your cheque at a payday loan company

If you don’t have a Canadian bank account anymore, you can use third party payday loan companies. For example Money Mart, Cash Money, CashCo Financial.

Important: These services charge fees, usually calculated as a percentage of the cheque amount plus a flat fee per item.

Example:

You have a $1,000 Government of Canada cheque and the payday loan company charges:

- 2.99% of the cheque value

- $2.99 flat fee per item

That would cost you about $33 in fees, leaving you with only $967 instead of the full $1,000.

Can I sign over my CRA cheque to someone else?

I get asked this question a lot—usually, whether it’s okay to sign the cheque over to a friend with a Canadian bank account, and have them give you the money. My answer is always: it comes with a risk. You must trust that friend completely, because there’s a real possibility you could end up not receiving the money.

The official information:

CRA (Canada Revenue Agency) cheques — like tax refunds, GST/HST credits, or benefit payments — are issued specifically to the person named on the cheque.

However, the Financial Consumer Agency of Canada (FCAC) states >> here:

“A cheque can be cashed by someone other than the person named on the front of the cheque if they counter-sign it.

Check with your financial institution to find out if they accept counter-signed cheques. Not all financial institutions accept them.”

If you attempt to “sign it over” (endorse it) to someone else, a bank might accept it if all parties involved agree, the bank’s policy allows, and there are no restrictions printed on the cheque.

However: because it’s a government-issued cheque, banks may be more cautious and may refuse a third-party endorsement (someone other than the named payee) because of risk of fraud, identity issues, etc.

Get your money faster with direct deposit

Important: If you’ve never filed a Canadian tax return, you cannot register for a CRA Account or set up direct deposit. You must first file a Canadian tax return. >> Here you can find a helping hand how to register for the CRA account.

If you already filed a Canadian tax return: Instead of receiving cheques, you can have your tax refunds and benefit payments deposited directly into your Canadian bank account. This method is faster, more secure, and reduces the risk of lost or delayed cheques.

How to Set Up Direct Deposit with the CRA:

Online (Fastest Option):

- Sign in to your CRA account.

- Select your Individual account to access My Account.

- Select Profile.

- Scroll to Direct deposit.

- Select Edit.

- Update your direct deposit information.

Your CRA direct deposit information will be updated the next business day.

Through the online banking of your Canadian bank:

In the online banking, go to “Customer Services”, and then look for “Set up direct deposit with the CRA”. Once set up, our CRA direct deposit information will be updated the next business day.

In Person: Visit your bank to set up direct deposit for your CRA payment.

By Mail (Longest Processing Time): Complete the Canada Direct Deposit enrolment form and send it to the Receiver General for Canada at the address indicated at the bottom of the form.

Processing time can take up to 3 months.

Wise - A great option to receive money

If you have an online CRA Account, set it up before you leave Canada and you are good to go!

Here you can open a free Wise account.

Once your account is set up, you can generate Canadian bank details directly within Wise.

Then, simply update your direct deposit information in your CRA online account with your new Wise details. This way, you’ll continue receiving payments even after you’ve left Canada.

After that, you can close your Canadian bank account and rely solely on your Wise account until you’ve filed your tax return and received your refund. Once the funds arrive in Wise, you can easily transfer them to your bank account back home.

As a bonus, if you use the button below, Wise will waive the fee for your first transfer of up to $800 CAD — how awesome is this?

Just make sure Wise is available in your country before you get started.

I am already outside of Canada

The CRA does not deposit tax refunds into foreign bank accounts; direct deposit is only available through Canadian banks and credit unions. Therefore, if you plan to leave Canada, the easiest way to receive your final tax refund is to

- keep your Canadian bank account open until your return has been fully processed

- or change the direct deposit to a Wise Account as explained above

If you have filed Canadian tax returns before and received your refunds by direct deposit — and your Canadian bank account is still active — your refund will be deposited automatically, just like previous years.

However, if that account has already been closed, the CRA will issue a cheque and mail it to the address you provided on your tax return.

Just a heads up: it has often happened that refund cheques were sent to the address in the CRA system. So if you listed a Canadian address on your last tax return and haven’t updated it since, your refund cheque may be mailed to that old address.

I recommend updating your address in the CRA Account to your current home address before filing your tax return.

If you are not in Canada anymore

If you’re outside of Canada you can try to cash the cheque at your bank in your home country. Most banks will accept it, though processing times and fees may vary.

You can only set up direct deposit to a foreign bank account for pension payments and not for other types of government payments. See more info >> here.

My bank refuses to cash the cheque because it is too old

Even though Government of Canada cheques never expire, some banks may refuse to cash them if they’re very old or damaged. If this happens, don’t worry — you can have the cheque reissued with a current date at no cost.

To do this, simply mail the original cheque (without altering or signing it) to the following address:

Imaging and Receiver General Operations Directorate

Returned Cheques

PO Box 2000

Matane QC G4W 4N5

Include a short note requesting that the payment be reissued. If possible, provide your full name, address, phone number, and a copy of your identification or correspondence from the CRA related to the payment.

Once received, the Receiver General for Canada will verify the cheque and issue a new one. Processing time can vary, but you’ll typically receive the new cheque within a few weeks.

What if my bank does not accept foreign cheques at all?

If you are unable to cash the cheque in the country you are living in, you may request to have your payment wire transferred into a foreign bank account. This should work for all IEC countries that are listed below.

- Australia

- Austria

- Belgium

- Chile

- Croatia

- Great Britain

- Luxembourg

- Netherlands

How to proceed:

Return the cheque(s) with a letter providing the following information:

- Currency type (CAD, USD, EUR or the currency of your choice)

- The financial institution’s name and address

- The financial institution’s bank account number

- Type of account (savings or chequing) if required

- Bank Sort Code (IBAN or bank sort code of 6 or 9 digits)

- SWIFT/BIC Code

- Your name, address and signature (no electronic, digital or stamped signatures)

Depending on the country you live in, some banks may require additional information to be included to process a wire transfer. We suggest that you contact your bank to determine if any additional requirements are needed and include them in your request.

The CRA needs this information each time you return a cheque to have the payment reissued in a different currency or by wire transfer.

Send the cheque and the letter to:

Imaging and Receiver General Operations Directorate

Cheque Inquiry Unit

P.O. Box 2000

Matane QC G4W 4N5

Canada

Even if you don’t live in any of the above countries, and this is your very last resort, try your luck anyway.

Explain your situation clearly:

- That you are living outside Canada,

- That your bank does not accept foreign cheques, and

- That you would like to know if there’s an alternative way to receive your payment (for example, direct deposit or international transfer)

While approval isn’t guaranteed, the CRA or Receiver General may still be able to help you find a solution on a case-by-case basis.